KMI Wire and Cable No Longer a Myth

SLOW EXECUTION, BUT IT’S NOW GAINING PACE

“Yeah we know it’s big, but I am not buying it, since government has execution risk.”- most investors I believe most investors know that 35.000 MW is a big and even great project, but the problem is investors also understand this mega project always has execution risk mainly comes from land acquisition and of course financing issue. But PLN admitted that 60% problem is a land acquisition.

35.000 MW project would need 46.000 kilometer transmission and every 1 kilometer transmission need around 3-4 tower. Each 1 tower (500 KV) need 625 m2, while 1 tower (150 KV) need 225 m2, in total PLN would need 25.000-80.000 towers. You can imagine how big PLN need a land to build this project.

Yet, on October 2016 we highlighted some important moments.

- This month, President Joko Widodo inaugurates electricity projects in Papua.

- PLN starting a PLTU 1.000 MW construction projects at CILACAP

- PLN starting a PLTU 2 x 1.000 MW construction projects JAWA 7 at BANTEN

- PLN signed a loan agreement with JBIC to build PLTGU JAWA 2 ( 800 MW ) at TANJUNG PRIOK

- Pertamina consorsium chosen by PLN to build PLTGU JAWA 1 (2 x 800 MW) at SERANG

KMI WIRE (KBLI) also said they understand that 35.000 MW project is now gaining pace and since we are getting closer to 2019 where Indonesia will have an election again, it’s important for Jokowi to speed up this project.

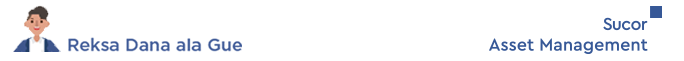

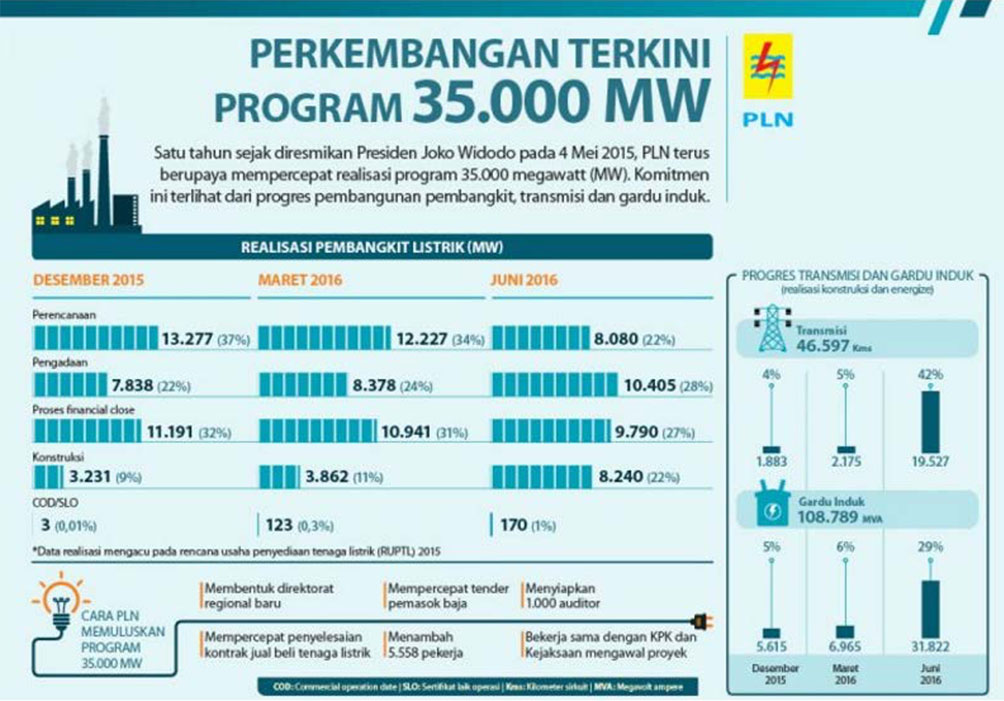

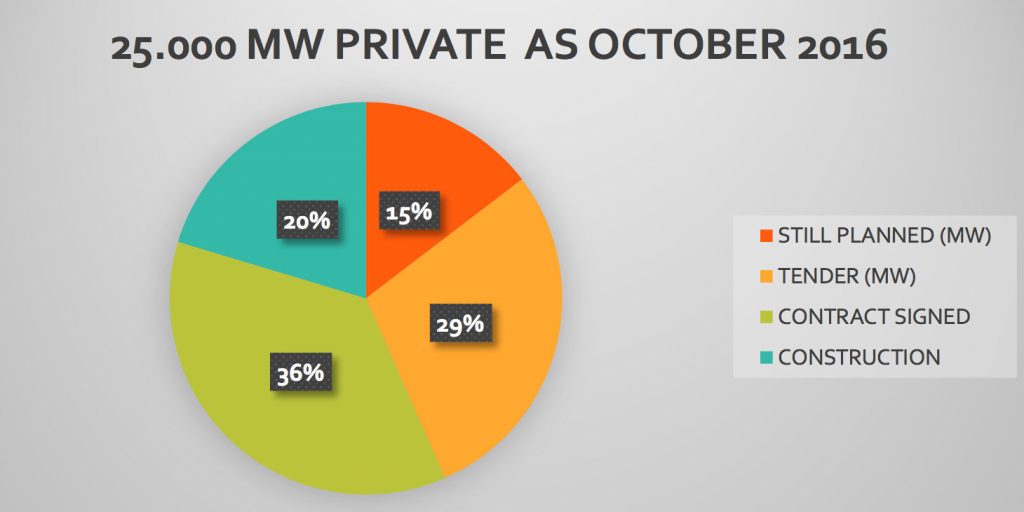

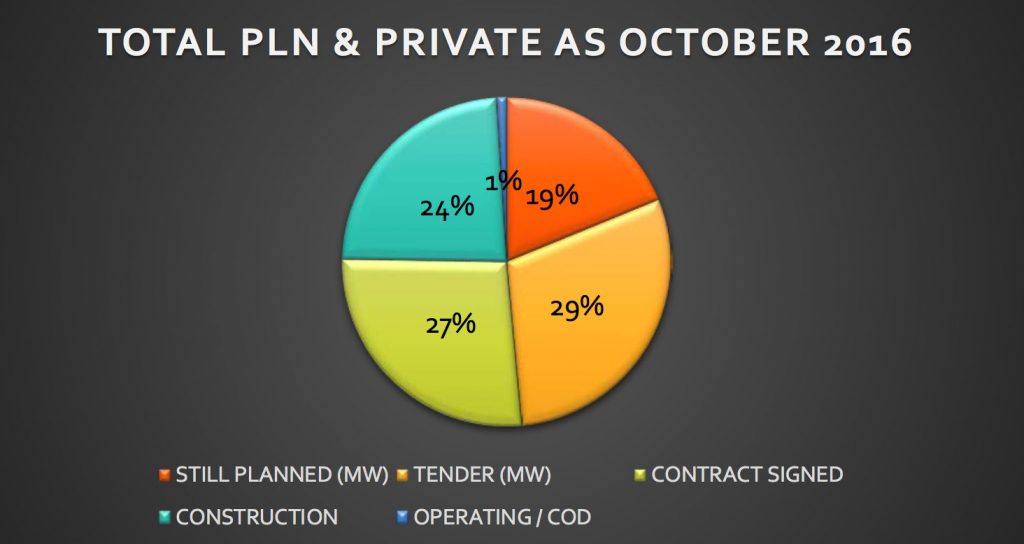

All in all, let’s see the progress of this mega project starting on December 2015 until October 2016 (source : pln.co.id).

We are seeing a huge development progress in this project.

According to Mr. Sofyan Basir (PLN Director), on October 2016, planned power plant projects down to 19% from 37% on December 2015 and power plant construction jump to 22% from 9%, 10 months ago.

We expect this number to keep improving starting from this 4Q 2016. PLN expect all power purchase agreement (PPA) for 35.000 MW project would be concluded this year.

New captain on ESDM, Mr. Ignatius Jonan and Mr. Arcandra Tahar were assigned by Mr. Joko Widodo to take care of this project.

Indonesia Private Power Plant Association (APLSI) expect this duo leaders to make a breakthrough, thus will lead to a better execution.

We are happy that government prioritize local content product to build this project and after looking at the latest development, we are becoming more confident on our conviction that cable sector is now entering multi years growth story.

KMI WIRE & CABLE (KBLI.IJ) “WHEN GROWTH MEETS INTEGRITY”

PT KMI Wire and Cable Tbk. is one of the major cable manufacturers in Indonesia and is one of the qualified suppliers of power cables for PT. Perusahaan Listrik Negara (PT. PLN). The Company was founded in 1972 under the Law of Foreign Investment (FDI) with foreign business partners, Kabel-und Metallwerke Guetehoff -nungshuette AG of Germany and starts the production of low voltage power cables and telephoned wires on a 10 hectares site in Cakung area, East Jakarta, in 1974.

According to their annual reports, the Company’s markets include of domestic and overseas. For domestic market it throughout Indonesia with distributors located in Jakarta, Semarang, Surabaya, Makassar, Balikpapan, Palembang, Pekanbaru, Batam and Medan. As for overseas which covers Asia Pasific, Australia, Europe, and Africa. In 2010, the company successfully developed a new product which is called Aluminum Conductor Composite Core (ACCC). The advantage of this product is that it can transmit electricpower two times higher as compared with conventional conductor.

In 2015, The sales of electric cables with copper conductor is still a major contribution revenue for KBLI, accounted for 66.7% of the total sales, although it declined from the 77.6% achieved in the previous year.

Meanwhile, the sales of aluminum cable products, almost all of which were supplied to PLN, saw a sharp increase of 29.7%. It seemed that the 35,000 Megawatt program compelled the PLN Distribution to accelerate its network development, as the demand for cable significantly rose.

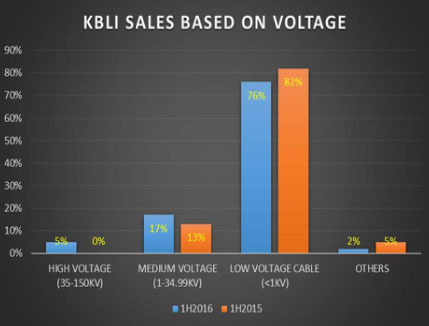

One year ago, the Company invested in production and testing machines for high voltage cables (up to 150 KV). The installation and testing of the production and testing machines have been done and the result is satisfactory. Company had completed the constructions of facilities for producing high-voltage (150kV) underground cables. Product certification process and commercial preparations are completed in mid- 2016. Hence, the output of this new facility shall be in the market in the second half of 2016.

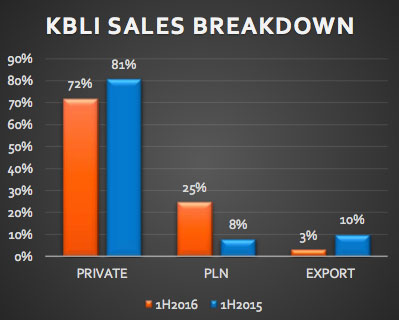

With this 35-150KV product (medium and high voltage cable), KBLI is more than ready to serve PLN high demand on it’s 35.000 MW project, and the growth story has just begun. As you can see below, of IDR 1,287 T sales in 1H 2016 (vs IDR 1.181 T in 1H 2015) the PLN contribution rising sharply in 1H 2016 vs 1H 2015 (IDR 326 Bn vs IDR 100Bn), so does with Medium Voltage and High Voltage cable ( starting on 2016) sales which provide higher margin. KBLI 1H 2016 net profit also jumped to IDR 142 Bn vs IDR 44 Billion in 1h 2015. IMPRESSIVE !

In 2016, KBLI has total production capacity 26.000 MT for copper cable and 16.000 MT for alumunium cable. KBLI expect 2016 sales to reach 28.218 MT combined, and by 1H 2016 they already sold 11.796 MT cable.

We are so eager to know the latest development of their business, so we decided to visited KBLI in one rainy day. KBLI office is quite unique, there is a so called fly over before you arrived at the lobby. After security check and waiting a few minutes, KBLI corporate secretary Mr. Asep Kusno and Mr. Made showed up to kick off the meeting.

They explained to us that KBLI net profit in 1H 2016 jumped on the back of :

They explained to us that KBLI net profit in 1H 2016 jumped on the back of :

- Lower COGS (copper and alumunium price had prolonged downtrend)

- Stronger Rupiah vs USD, helped company turning from forex loss to forex gain

To prevent another forex loss series, KBLI is now hedging their COGS and also their debt by buying forward or hedging paper.

KBLI applied prudent principles when it comes to contract agreement. To prevent the increase in raw material prices, company has always set the contract value based on the price of copper and alumunium futures contracts. As of June 2016, for 3,98% weakening in IDR vs USD, it will only subtract about IDR 1,8 billion on KBLI’s earning after tax. So going further, we can say that KBLI is safe from greater forex loss risk.

KBLI is a unique cable manufacturer, you will not find KBLI cable products in free market like supermarket and building material shops. KBLI always sold their cable right right into their distribution channel and constructor like property developers. KBLI’s inventories are made based an order, so if you see a bulking up inventories in 1H 2016, it is because they will deliver most of it to PLN in 2H 2016.

According to Mr. Asep, KBLI is much more like construction company where most revenue will comes in second half of the year. On average, KBLI will need around 2 weeks-4weeks to produce the cable and concluded the offering package.

KBLI will receive a payment between 1 month – 3 months after delivery from PLN (depending whether it’s PLN distribution business or PLN transmission business). If the orders came from constructor, KBLI will receive a payment between 3-6 months after the project energized.

Copper cable sales decreased during the last 1 year because of weak demand from the property sector. But luckily, demand for alumunium cable from PLN began to rise sharply as government getting serious with 35 GW project.

This year, KBLI expecting PLN will contribute 30-40% of its sales (vs 1H 2016 25%) and next year will rise to 45%. Higher PLN contribution will expand KBLI gross margin since PLN demand for 35 GW project are much more concentrated on medium voltage – high voltage cable.

KBLI already secured new 2017 Rp 400 billion contract for high voltage project from PLN (total IDR 1,8 trilion). Company hope it’s copper cable sales will pick up in 2018 since they expect property market will recover by that time, thus lifting copper cable demand.