Property: Darkest before dawn

Business model analysis, forecasting, profit/loss, balance sheet, and cash flow analysis are the pillars of equity investment analysis

Working as member of Sucorinvest Asset Management , we believe that we have got all these basics covered. However, to create more values for our investors, we have been doing more than the above. A great deal more.

Walking under the rain, feel the sun’s heat, we love to get our foot dirty. That’s why we like to talk to as many relevant people as possible.

Chatting with small business people, for example, will give us a good sense of what really happens on the ground.

After hearing the inputs from the people we talked to, We can connect the dots better, linking company’s guidance, economic data, and then make our investment decision.

Getting our foots dirty in Serpong, daytime and nightime

Few weeks ago, at one area in Serpong, which at one point was the epicenter of the property bubble in greater Jakarta, I had a dinner at a food tent in front of shophouse area around Gading Serpong, Tangerang. I ordered a cakalang fish rice, the food is delicious and spicy enough to warm my body from a heavy rain outside. When I still enjoyed my dinner, I heard the owner’s conversation with his friend.

He looked a bit stressed out. And i don’t think it is driven by eating hot Manadonese food, “ah bro, I used to think that property price will keep going up, that’s why I decided to buy it with a bank loan 2 years ago, I thought if I bought it and sell it a year later, I could get a “free money”, but ahhhh now the price is stuck, I have to pay monthly maintenance fee, a lot of people selling at loss because they can’t pay interest, I have to survive in this condition bro, usually I closed my tent at 5PM, now I closed it at 9 PM and even open it on Sunday.”

His friend replied “yes bro, I understand, I was lucky to buy property a little bit earlier than you and now I still yeah enjoyed modest price balance sheet, and cash flow analysis are the rise although it’s now stuck too. My property agent told me let’s hope tax amnesty program can boost property price again.”

Property Bubble

That night, the rain was heavy, so was with the owner’s burden. After his friend left, I approached him and asked many things about his business and property asset. From him, I learned there is still a “common perception” in many people’s mind including him, that property and gold price will always go up and considered as a safe heaven asset. But, the last 2 years prove him that there’s no such thing as a safe heaven, every asset would have up and down season.

Although currently bearing a loan burden and is now cutting back his family entertainment and holiday expense, he determined to survive and pay all of his bank loans. Unlike many property owners (or speculator) who now sold their property even at a loss, he believe one day he will reap a gain from his property asset. He just doesn’t know when it will happen but hope the dawn will come sooner rather than later.

Partly to support this determined businessman, I decided to take out another pack of cakalang rice, then heading home. On the way home, I kept thinking and asking myself “is the property market really that bad ? Yes, everyone knows it is slow. But that’s hardly not known and unique. Singapore is also as slow, isn’t it? Or is it worse than what most think it is?

I still remember in late 2010-2014, people queueing (including my relatives who still owned some property assets at Serpong !) when a property developers launched their product. They start queueing in the morning so they could got NUP (Buyer Booking Number). Does getting a NUP guarantee them to get the property they wanted ? NO, they had to “win” that property in a lucky draw since 1 property unit could attract 10-20 potential customers.

Here are the pictures from nanamorina.com. You can see a lot of people queueing to buy an apartment at Gading Serpong, back in late 2014.

300 % IN 5 YEARS ? INSANE RALLY

The reason why property prices, especially in Serpong rising sharply in 2010-2014 was because of its location that close to Jakarta, infrastructure & public facilities development, strong economy growth, low interest rate, low LTV (loan to value) rate, bolstered even more with market maker action to pumped property price.

Many property experts held a seminar or wrote a book to teach people how to buy property without money, how to get rich from property, etc.

PARTY IS OVER (FOR A WHILE)

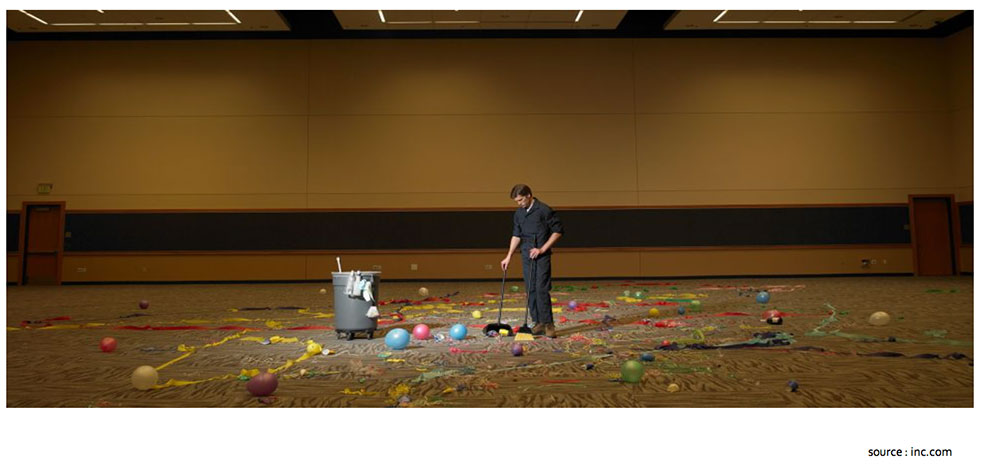

Yet, just like a party that must be over, so does with the property booming. No more free money !, in 2016, most property listed companies in Indonesia posted flat to weaker marketing sale . Could we blame the management and companies for this situation ? the answer is NO, since I believe all property developers and its management will always wants an uptrend property market. Here is total marketing sales from 7 public developers companies in Indonesia. You can see their marketing sales topped out in 2014. (source : sucorinvest, companies)

Since 2015, property market at Serpong (and actually at most region in Indonesia too) slowly but sure entering consolidation phase, mainly because slower economic growth and also oversupply condition. This situation caught most property buyer / investor off guard, especially who bought a property with bank loans, hoping they can sell it 1 or 2 years after bought it ,suddenly they have to deal with stagnant or even lower property price.

At this stage, they need to consider a few options :

1. They try to sell it at profit (you know, selling property means you have to pay 2,5-5% tax !, not mention other kind of costs)

2. They will keep paying the loans plus interest, on the back of their faith that property market will one day recover again.

3. Sell it at a loss, because they are not able to pay the loans (naked speculator usually will do this one)

4. Try to find people who would rent the property, at least that will reduce the financial burdens (maintenance cost, security and cleaning cost), or they can use the rental income, but sadly that wasn’t the case.

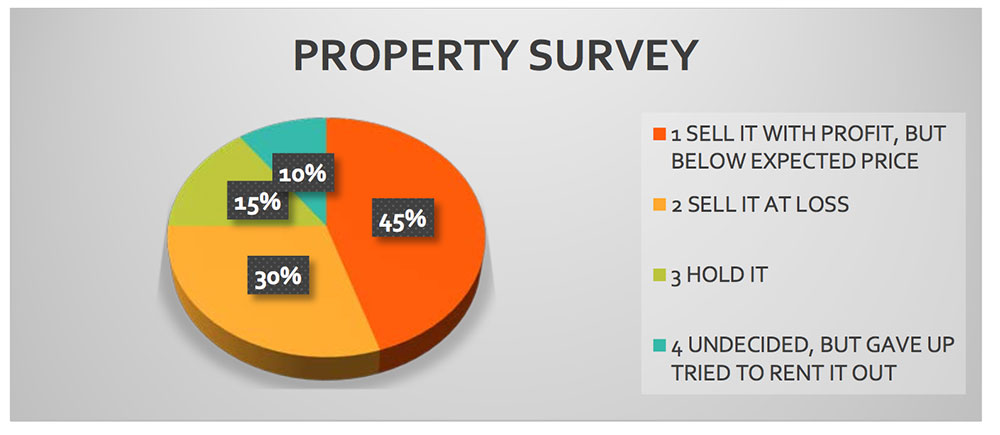

After we interviewed around 50 property buyers and agents in Serpong areas (we can’t disclosed respondents name and photos since they asked for a privacy), we got a result like this……

More than 45% of respondents decided to sell it with a “minimum” gain. They once thought property price in Serpong will rise 50-100% more in 2015-2016, but sadly it’s not happened, so they decided to sell it even with small gain 5-10% and it still subjected to 5% selling tax. Situation is better for buyer who bought property in 2011-2012, they are luckier because they don’t crystalize losses. Having said that, if they sell today, profit will be markedly lower than what it was a couple of years ago., so hardly anyone feels good, everything is short of the expectation.

About 30% of our respondents, said they have thrown the towel, sell their property assets and crystallize the losses, since interest expense (11-13% p.a.) exceeded current property price growth. Many of them were shocked to learn that property boom ended so abruptly and they also told me that many of their friends now entering so called financial storm. Their friends were bought more than 1 property unit or even 10 houses between 2013-2015, but now their business cashflow has a problem because of slower economic growth and to save the business, they need to sell their property even at loss. What matters for them is CASHFLOW.

About 15% of our respondents believe their grandma-grandpa wise words that land price never going down, so the property market will rise again in the future, so why not keep paying the installments ? Hats off to this kind of respondents.

Around 10% respondents have grown tired waiting for people to rent their property. They told us that current rent rate is only around 2% or even less of their property price, even bank deposit rate still moving around 6-8%. Actually, they don’t bother about 2% rent yield as long as their property price keep going up around 15-20% a year.

Almost all of our respondents believe that current ample supply at Serpong is a reason why they find it hard to sell or rent at their expected prices.

At Sucorinvest Asset Management, it is in our DNA to do a channel check, we decided to stay at Serpong from evening until late of night, that’s when most people already go back to their home and we can really see how many houses that are still vacant.