Ramayana Lestari Sentosa “THIS TIME IT’S REAL”

The Dawn Has Come, Further Re-Rating Ahead

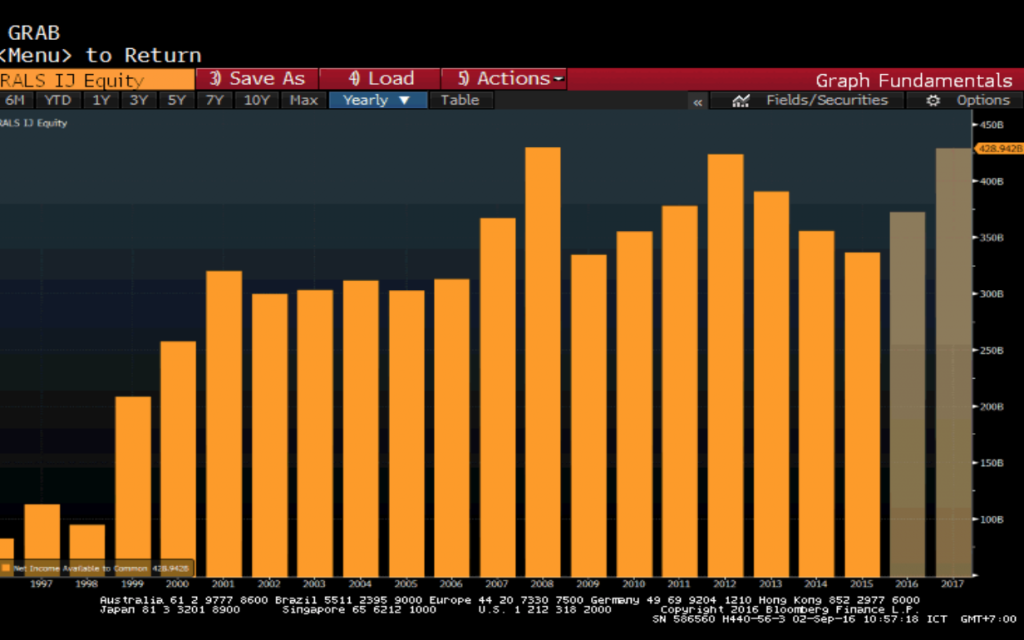

After doing all “on the ground” works, we back to the numbers. If you look at Ramayana net income since 2001 until 2015, the CAGR is basically below 1 %, which is so so bad and I can understand when most analysts and PM didn’t buying the turnaround idea.

The consensus currently stood at IDR 375 Billion and the all time high net profit was posted back in 2008 (IDR 430 billion). But with astonishing 1H 2016 result where we can see all sales and margin improvement, I expect that Ramayana will post ALL TIME HIGH NET INCOME in FY 2016 and continue double digit growth in the coming years.

I always believe that numbers will be driven by strong story and this time, here we have a company that has promising turnaround story where they not only depend on improving economy outlook in Indonesia (low CPI, better commodities prices, tax amnesty effect multiplier effect), but they also addressing their main problems which hindered their performance in the last 10 years.

For valuation, with further improvement expected, mainly on ROE and NPM, then of course the company deserved another RE- RATING. I also believe it wouldn’t be a “one year story” because, I think Ramayana will start regaining their market share from competitors.